Exploring South Korea in 2025 isn’t just about taking pictures of historic palaces or chasing the latest K-drama filming locations anymore; it has evolved into a full-scale immersion into a premium lifestyle. We at KCulture.com have analyzed the latest tourism big data from January to November 2025, revealing a massive shift from “sightseeing” to “lifestyle consumption,” with medical wellness and the rise of American travelers leading the charge. In this report, we break down how Seoul remains the ultimate hub of activity, why medical tourism is the new shopping, and what these numbers actually mean for your next trip to the peninsula.

- Understanding the Data: Methodology and Key Notes

- Regional Activity: The Dominance of the Greater Seoul Area

- Changing Faces: The Diversification of Visitor Origins

- The Wellness Boom: Medical Tourism Takes Center Stage

- Seoul’s Spending Hubs: The Jung-gu and Gangnam Rivalry

- Insider Take: What This Means for Your Korean Journey

Understanding the Data: Methodology and Key Notes

Before we dive into the fascinating numbers, it is important to understand how we gathered this intelligence. This report is based on big data provided by the Korea Tourism Data Lab (managed by the Korea Tourism Organization). We compared data from January to November 2025 against the full-year figures of 2024 to identify emerging trends.

Our analysis relies on a combination of mobile roaming data (from major carriers like SKT) and foreign credit card transaction records. This gives us a granular view of where people go and where they open their wallets. However, a quick note on the terminology: when we refer to “visitor counts” in this report, we are talking about ‘Cumulative Visits’ or activity volume, rather than ‘Unique Arrivals’ from immigration records.

📌 Local Note: If one traveler visits Seoul, moves to Incheon, and then returns to Seoul over a week, they are counted multiple times in the activity data. This metric is specifically designed to show regional popularity and the actual movement patterns of tourists within the country.

Regional Activity: The Dominance of the Greater Seoul Area

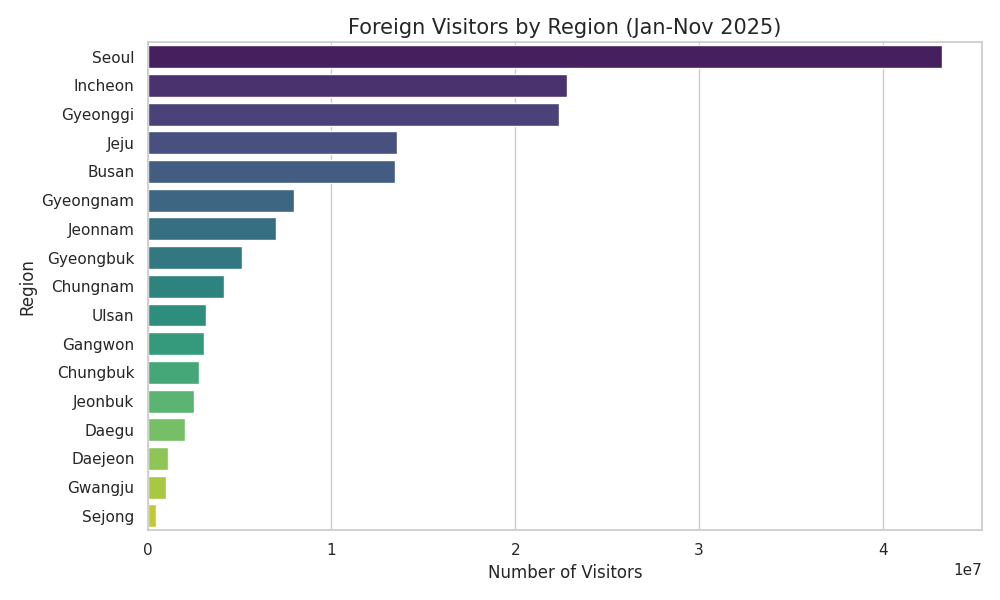

The magnetic pull of Seoul remains stronger than ever. From January to November 2025, Seoul recorded a staggering 43.24 million visitor activities. To put this in perspective, the next closest regions were Incheon (22.82 million) and Gyeonggi-do (22.39 million). This “Greater Seoul” concentration shows that while travelers are exploring more of Korea, the capital region remains the beating heart of the travel experience.

The high activity numbers in Incheon and Gyeonggi suggest that tourists are becoming more mobile. They aren’t just staying in their hotels in Myeongdong; they are taking day trips to the Suwon Hwaseong Fortress, visiting the cafes in Incheon’s Songdo International City, or exploring the nature trails in Gyeonggi. The seamless integration of the Seoul subway and bus systems into the surrounding provinces has made this high-mobility lifestyle possible for the average international visitor.

Changing Faces: The Diversification of Visitor Origins

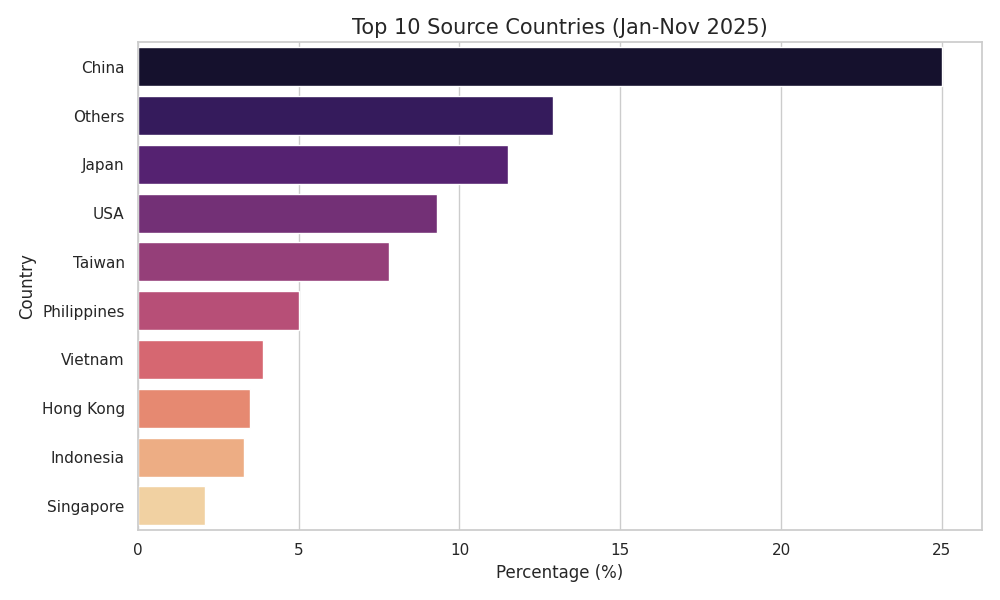

Who is coming to Korea? While the usual heavyweights are still present, there is a notable shift in the ranking. China continues to hold the top spot, accounting for 25.0% of the total visitor activity. However, the most significant growth story of 2025 is the rise of the United States. American tourism activity jumped from 8.0% in 2024 to 9.3% in 2025—a 1.3 percentage point increase that signals Korea’s growing appeal in the Western market.

Japan (11.5%) and Taiwan (7.8%) remain incredibly stable and vital markets. This diversification is healthy for the local ecosystem; it means that the shops in Hongdae or the restaurants in Itaewon are catering to an increasingly global palate. We are seeing more English-friendly services and a broader range of cultural offerings that go beyond the traditional “Hallyu” (Korean Wave) tropes to include authentic local living experiences.

The Wellness Boom: Medical Tourism Takes Center Stage

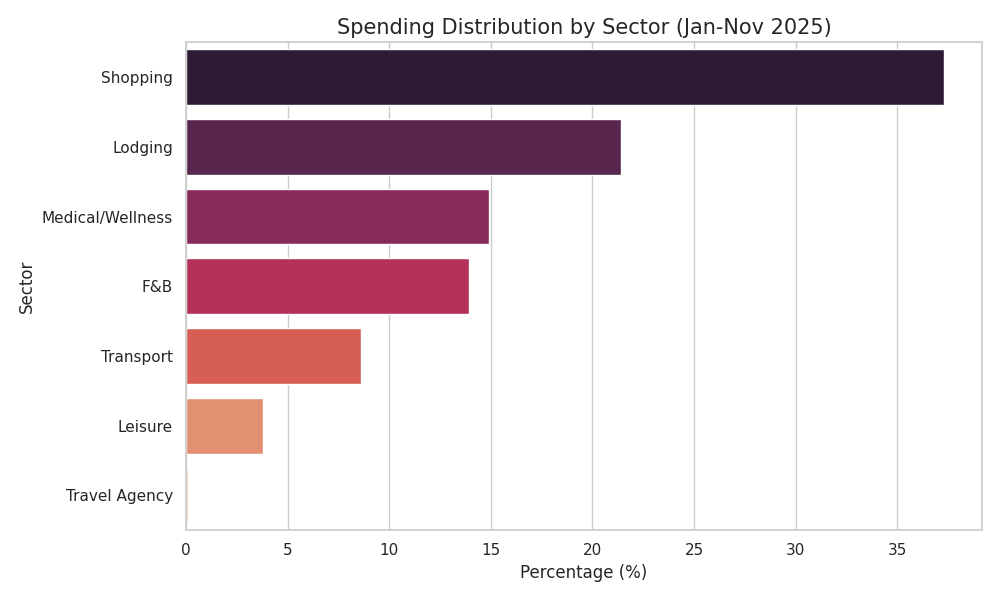

Perhaps the most shocking revelation in the 2025 data is the “Medical Wellness” explosion. For years, shopping was the undisputed king of tourist spending. While shopping still accounts for the largest share at 37.3%, it has seen a slight decline as visitors pivot toward self-care and professional medical services.

| Spending Sector | 2025 Share (%) | Trend vs. 2024 |

|---|---|---|

| Shopping | 37.3% | Slight Decrease |

| Lodging | 21.4% | Slight Decrease |

| Medical/Wellness | 14.9% | Significant Increase (from 11.8%) |

| Food & Beverage | 13.9% | Stable |

The spending in the Medical/Wellness sector rose from 11.8% in 2024 to 14.9% in 2025. What’s even more telling is that 78.2% of this wellness spending is concentrated specifically on professional medical tourism. This includes high-end dermatology, plastic surgery, and comprehensive health screenings. Visitors are no longer just buying face masks in bulk; they are investing in long-term health and beauty procedures performed by world-class specialists in Seoul.

Seoul’s Spending Hubs: The Jung-gu and Gangnam Rivalry

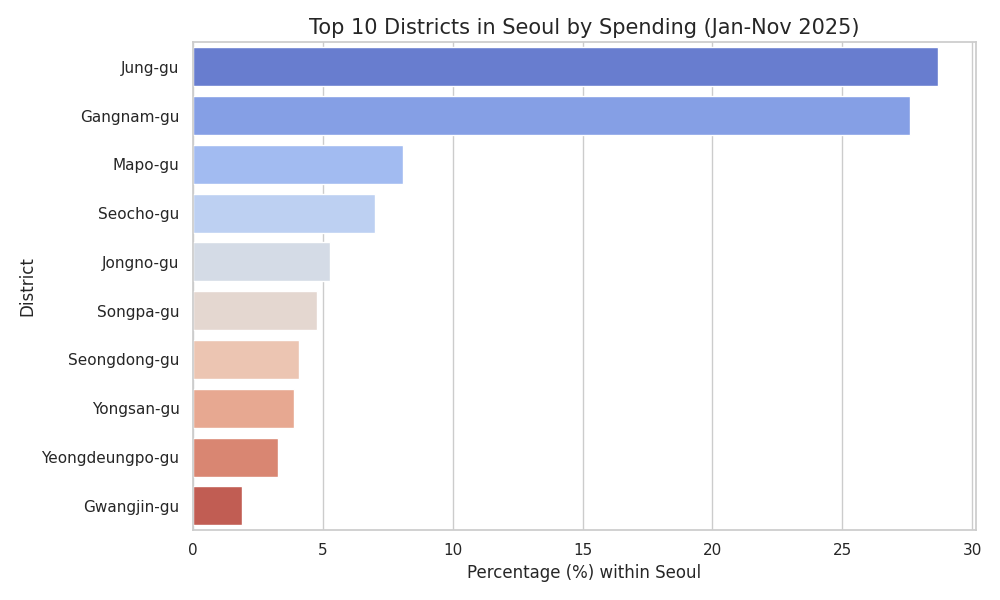

Where does all this money go? Inside Seoul, two districts dominate the economy, together accounting for over 56% of all foreign spending in the city. Jung-gu, home to the shopping mecca of Myeongdong and the historic Namdaemun Market, leads with 28.7%. Right on its heels is Gangnam-gu at 27.6%.

The rivalry between these two districts highlights the two faces of modern Korean tourism. Jung-gu represents the traditional charm, massive retail department stores (like Lotte and Shinsegae), and street food culture. Gangnam, on the other hand, is the headquarters of the medical wellness boom we discussed earlier. It is the destination for luxury brands, high-end dining, and the “K-Beauty” clinics that have become a global standard. Mapo-gu (8.1%), which includes the youth-centric Hongdae area, and Jongno-gu (5.3%), famous for its palaces and Bukchon Hanok Village, round out the top four spending hubs.

Insider Take: What This Means for Your Korean Journey

So, what can we conclude from these 2025 statistics? Honestly, the “Real Korea” is becoming a place where you come to upgrade your life, not just fill your suitcase. The shift toward medical wellness tells us that travelers trust the Korean infrastructure and expertise on a deeply personal level. The rise in visitors from the USA suggests that the cultural reach of Korea has moved past a niche interest into a mainstream travel aspiration.

If you are planning a trip soon, here are my local tips based on these trends:

- Book your wellness appointments early: With the 14.9% spending spike, the best clinics in Gangnam and Sinsa-dong are booking up months in advance.

- Explore the “Greater Seoul” area: The data shows everyone is moving between Seoul, Incheon, and Gyeonggi. Don’t be afraid to use the AREX or the Gyeongui-Jungang line to find hidden gems outside the city center.

- Jung-gu vs. Gangnam: Plan your itinerary by “vibe.” Go to Jung-gu for the heritage and heavy shopping, and head to Gangnam for the lifestyle, tech-infused cafes, and aesthetic treatments.

The 2025 data confirms that Korea is no longer just a destination; it’s an experience that stays with you (and on you!) long after you fly home. We’ll continue to monitor these trends to ensure you have the most up-to-date information for your Korean adventure.

Korean Culture portal KCulture.com

Join the mailing service and add to your favorites.

Founder of Kculture.com and MA in Political Science. He shares deep academic and local insights to provide an authentic perspective on Korean history and society.